Quickbooks Integration

Why we don't integrate with Quickbooks

Quickbooks is a powerful accounting software used by most of our clients. However, Propcart does not offer a Quickbooks integration for the following reasons:

Quickbooks doesn't provide "Scopes" to their API to limit access. So when a third party (like Propcart) gets access to your Quickbooks account, it gets access to EVERYTHING. Meaning it can read, create, update, and delete ALL of your Quickbooks data. Most prop houses don't want that. And we don't want that, because if something bad happens to your Quickbooks data, we don't want Propcart to be suspected.

However, assuming you were okay with that, the next problem is that Quickbooks doesn't make it easy to create and sync invoices and customers. Both Propcart and Quickbooks would contain your customer data, and there's a good chance the customer names are not the same, so it would be difficult to sync or merge these customers so that you can get your sales data (aka orders) from Propcart into Quickbooks. And because orders and invoices change so much, keeping both systems in sync with the same, accurate data makes this kind of integration even more challenging.

Propcart has the same capabilities as Quickbooks to create invoices, receive payments, and run the relevant reports. We modeled many aspects of our billing system off of Quickbooks, so if you're a Quickbooks user, you should find Propcart familiar.

Thus, the preferred solution is to not use Quickbooks for customers, invoices and payments, and to use Propcart instead. One single source of truth for all of your sales and billing data.

How to get your Propcart data into Quickbooks

It's easy to copy your monthly sales, sales tax, and payments data into a third-party accounting software like Quickbooks.

This is not tax advice. Please confirm this method with your accountant.

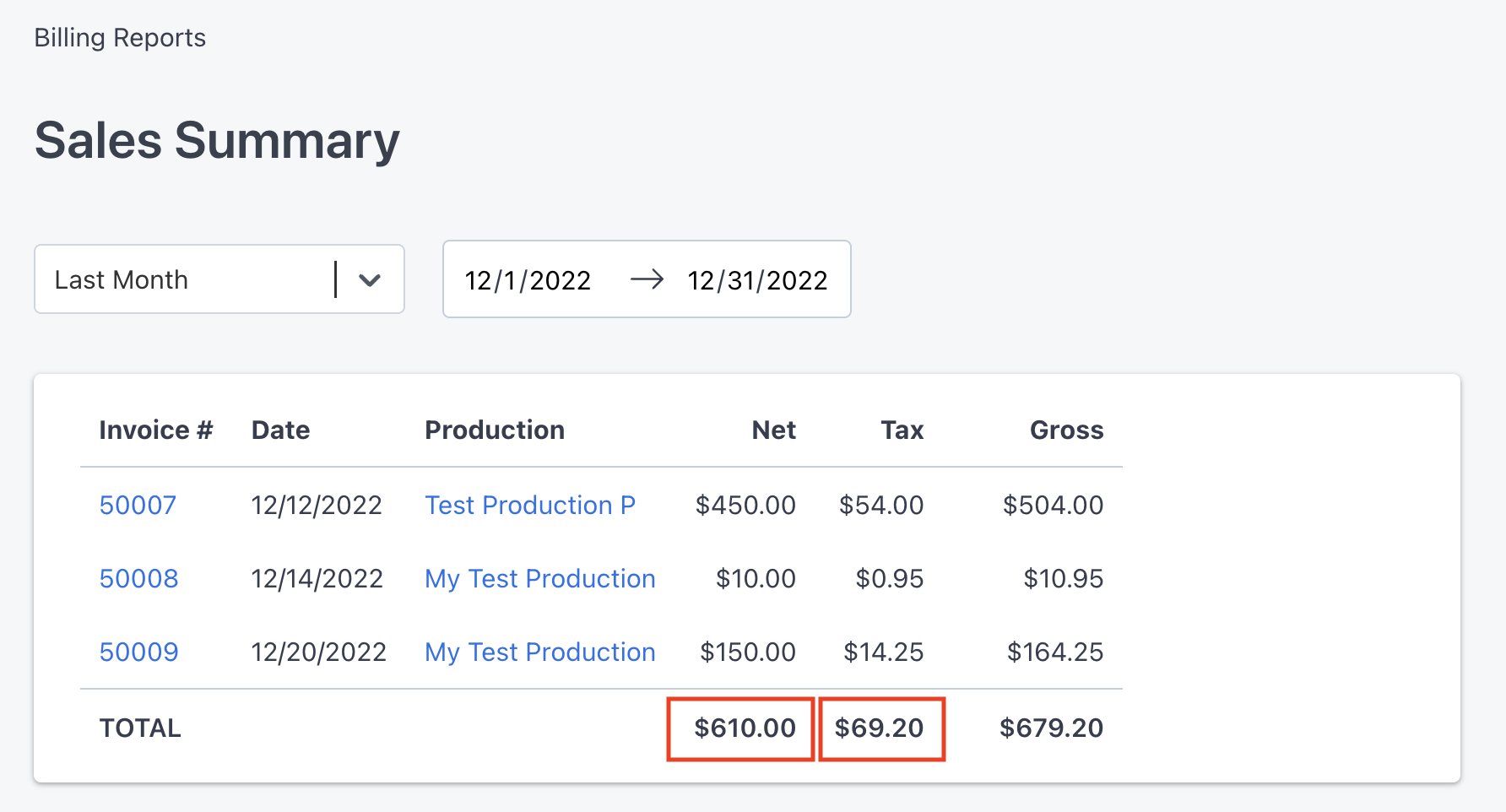

Go to your Billing Reports and click on your Invoiced Sales Summary.

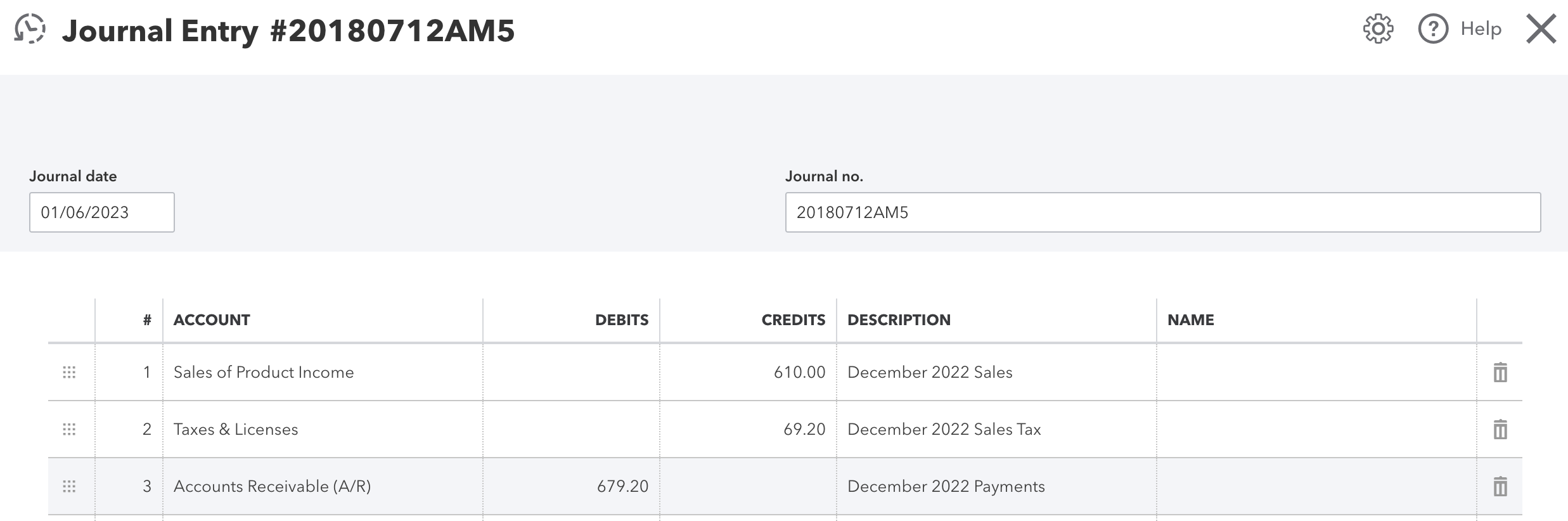

Open your third-party accounting software (e.g. Quickbooks) and click on the + New button then select Journal entry.

- On your Invoiced Sales Summary, filter your invoices by "Last Month", and note the Net Amount and (e.g. $610.00) and Tax Amount (e.g. $69.20).

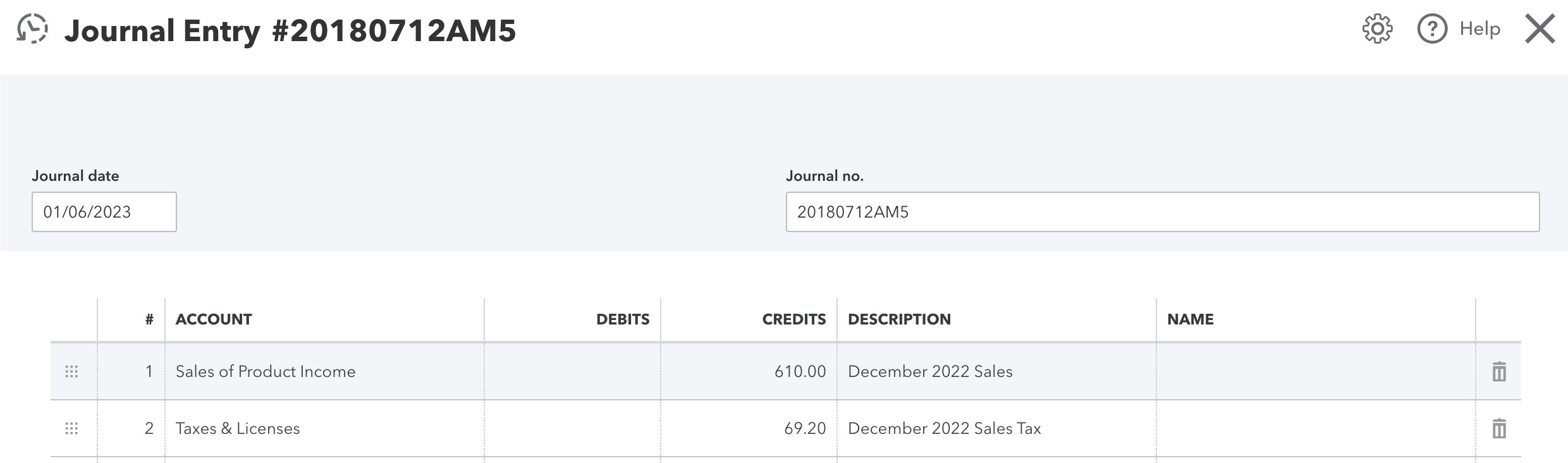

- Add these numbers to your Journal Entry as credits for "Sales of Product Income" and Taxes and Licenses respectively. Add a simple description like "December 2022 Sales" and "December 2022 Sales Tax" respectively.

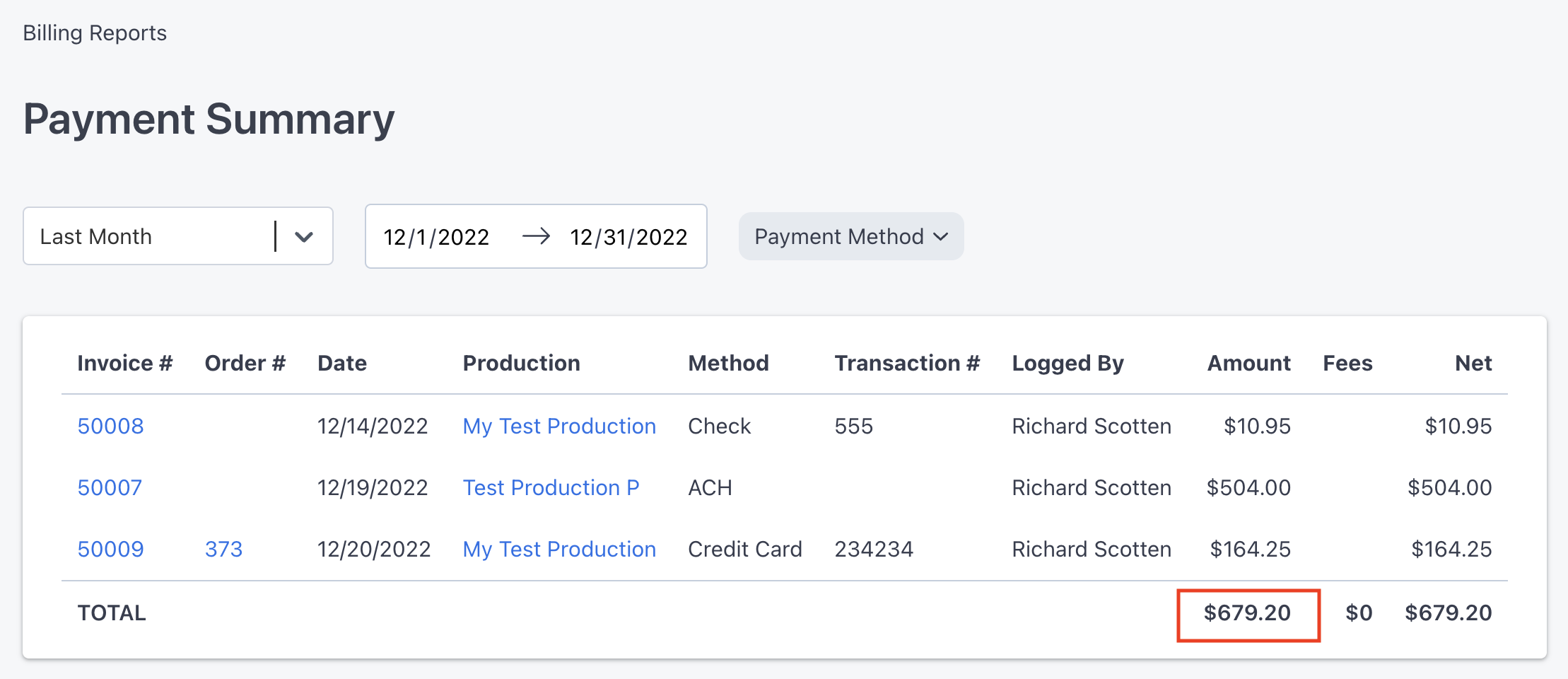

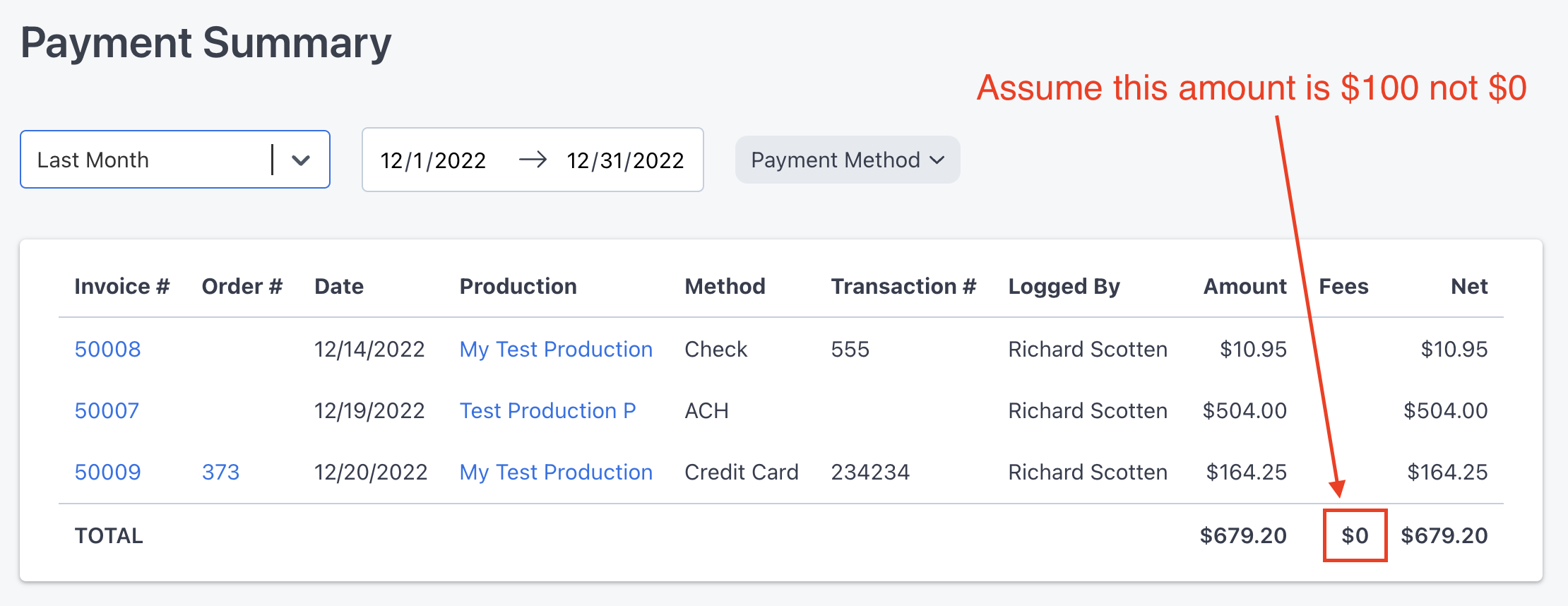

- Go to last month's Payment Summary, and copy the Total Amount (e.g. $679.20)

- Paste that amount into the third line item in your journal entry as a debit for "Accounts Receivable (A/R)".

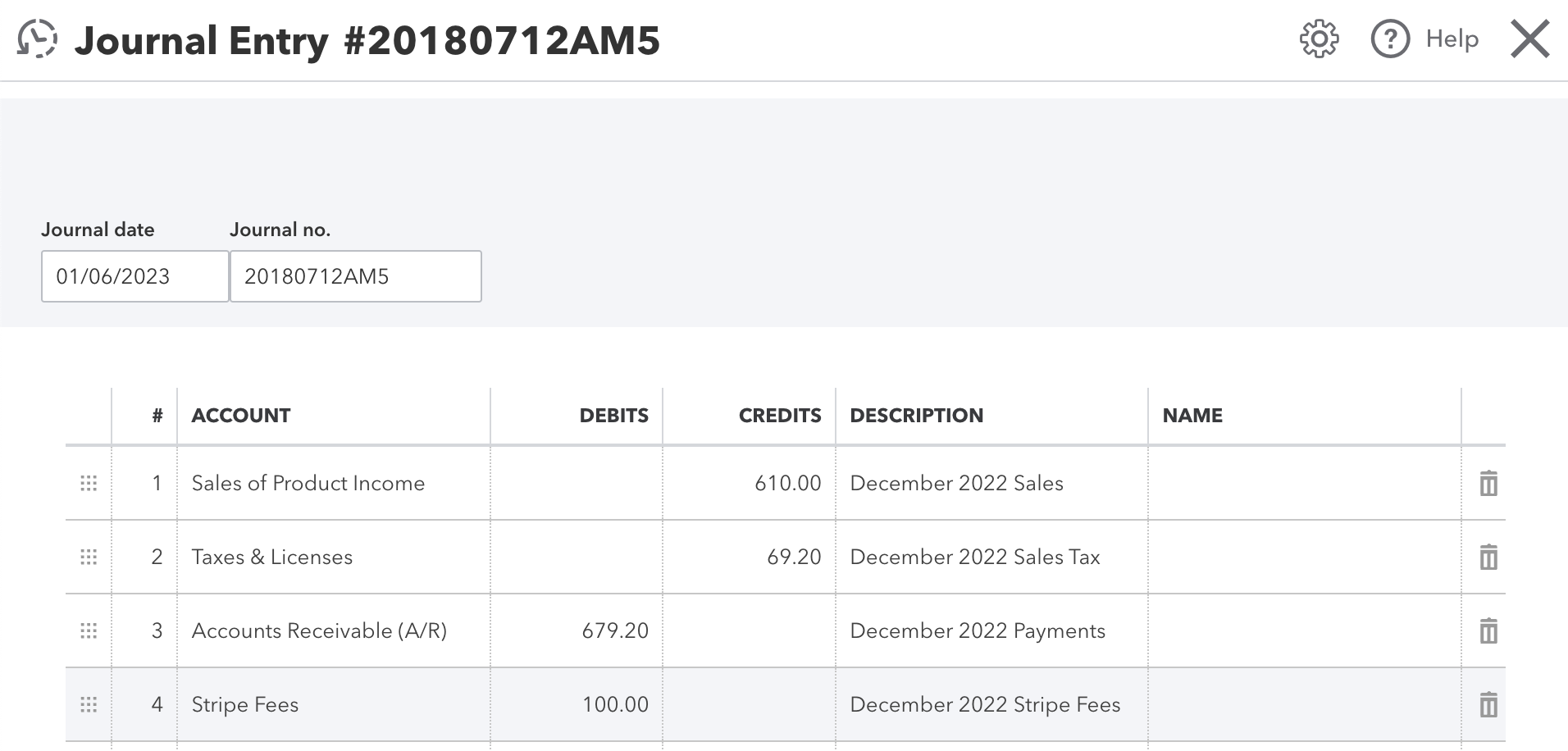

- If you have Stripe Fees that were withheld, copy the Total Fee amount (e.g. $100.00):

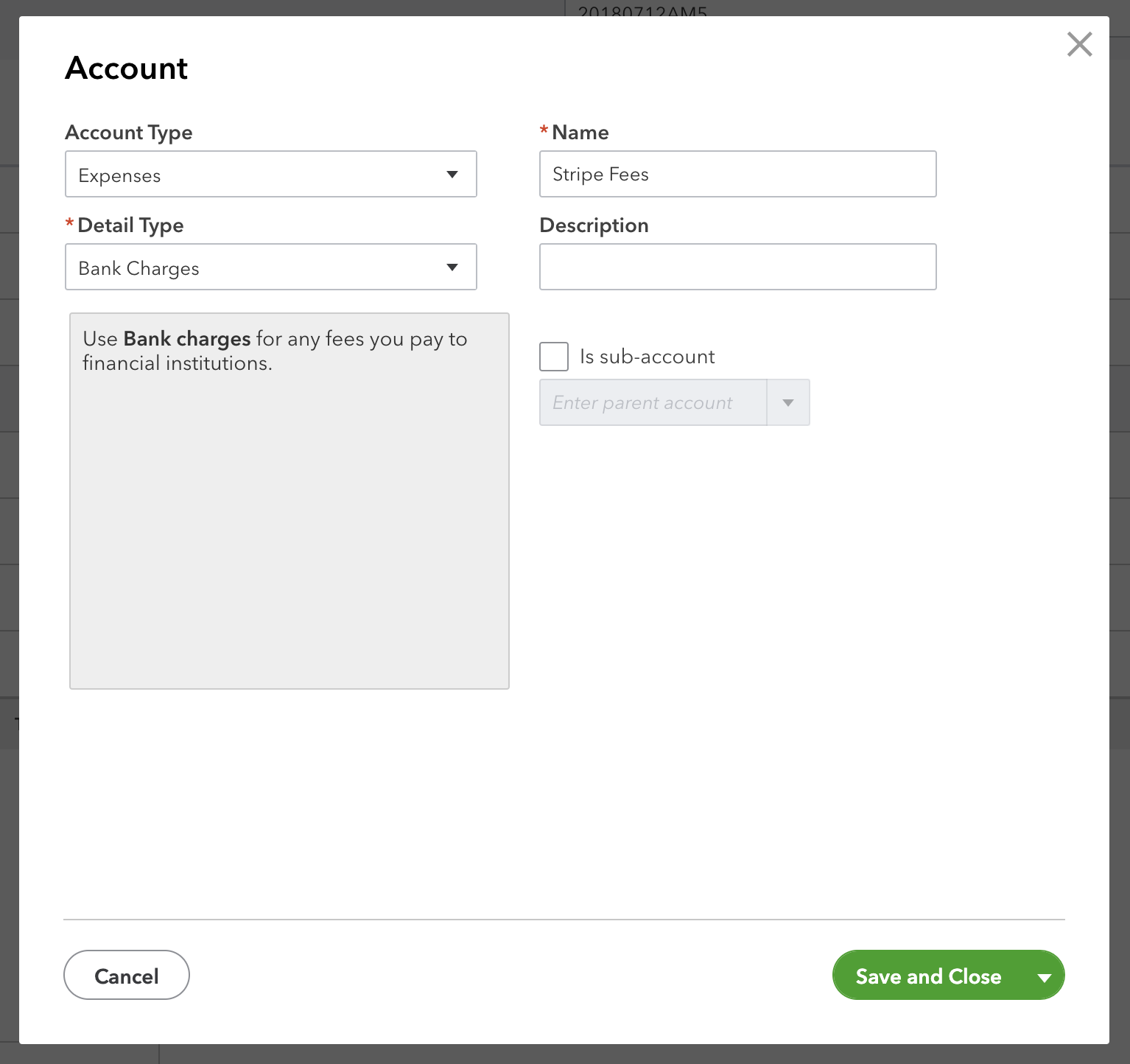

- Create an expense account for Stripe Fees on Quickbooks:

- Enter this amount as a debit for the fourth line item.

- And that's it! This information will now show up on your accounting reports like your Profit and Loss report.

Again, this is not tax advice. Please confirm this method with your accountant.